Home / Business and Economy / Asia Focus Fund: Growth Beyond Tech Giants

Asia Focus Fund: Growth Beyond Tech Giants

25 Jan

Summary

- Aberdeen Asia Focus invests in smaller companies outside major tech.

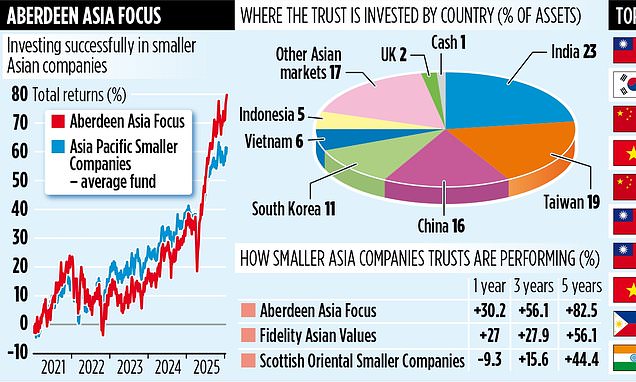

- The fund has returned 82.5% over five years and 30.2% last year.

- India is the fund's largest country holding, with China and Vietnam overweight.

The Aberdeen Asia Focus investment trust distinguishes itself by targeting smaller companies across Far Eastern stock markets, diverging from the common focus on large technology firms. Manager Gabriel Sacks emphasizes this strategy offers investors deeper and broader exposure to the Asian economic landscape. This approach has proven fruitful, with the fund delivering a significant 82.5% return over the past five years and 30.2% in the last year, outperforming similar trusts.

The fund, managed from London with support in Singapore and a broader Asian investment team, holds approximately 60 stocks with an average market capitalization of £3.5 billion. It excludes Japan and Australasia, with India being its largest country holding. Assets are diversified across 13 stock markets, primarily in Asia, with a notable holding in UK-listed MP Evans Group for its Indonesian plantation crops.

Sacks notes an underweight position in markets like India, South Korea, and Taiwan, while maintaining overweight positions in China and Vietnam. The strategy prioritizes market diversification and identifying quality companies at reasonable prices, acknowledging specific risks such as regulatory challenges in China. Success stories include Taiwanese tech firm Chroma ATE, whose shares rose nearly 200% in the past year, and Vietnamese retailer Mobile World Investment, with shares up 45% in the last year. The trust offers a quarterly dividend, yielding approximately 1.7% annually. Its shares are currently trading at a 10.5% discount to their underlying asset value, presenting a potential opportunity for bargain hunters.