Home / Business and Economy / 2026 Stock Market: Gains Expected, Volatility Looms

2026 Stock Market: Gains Expected, Volatility Looms

24 Dec

Summary

- Stock market poised for another year of gains in 2026.

- Concerns linger over the AI rally and elevated market volatility.

- Resilient economy and Fed policy to support corporate profits.

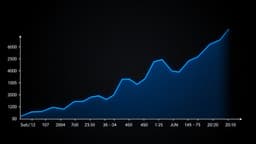

Wall Street strategists are projecting another year of stock market gains in 2026, though with potentially more modest returns and continued elevated volatility. The S&P 500 is on track for significant growth, driven by expectations of rising corporate earnings, supported by a resilient U.S. economy and accommodative fiscal and monetary policies.

However, significant debate surrounds the sustainability of the artificial intelligence rally. Some experts liken current tech IPO performance and investor behavior to the Dotcom Bubble, citing concerns about inflated valuations and infrastructure investments that may not yield returns. Others argue that today's AI companies possess stronger fundamentals than their 1990s counterparts.

Investors are advised to remain prepared for periodic market swings, as factors like potential shifts in government policy and market concentration could contribute to ongoing volatility. While a softening labor market may pose risks to the broader economy, it could also prompt further interest rate cuts from the Federal Reserve, potentially influencing market dynamics.